42

As a result of increased incidents of conventional

security systems (such as passwords and PIN) being

compromised in Nigeria, there has been a high demand

for more secure banking platforms. Keeping this

objective in mind, the Nigeria Inter-Bank Settlement

System (NIBSS) Plc, established in 1993, and owned

by licensed banks including the Central Bank of

Nigeria (CBN) and discount houses, in February 2014,

was assigned the responsibility to manage the Bank

Verification Number (BVN) enrolment for Nigerian bank

account holders in Nigeria and globally.

The BVN scheme is a centralised biometric identification

system for Nigerian bank customers. The aim of

introducing BVNs is to create a stronger ‘Know Your

Customer’ (KYC) process to uniquely verify every bank

account holder’s identity, and to strengthen the various

security platforms in place, thereby facilitating increased

lending as customer identity doubts are reduced.

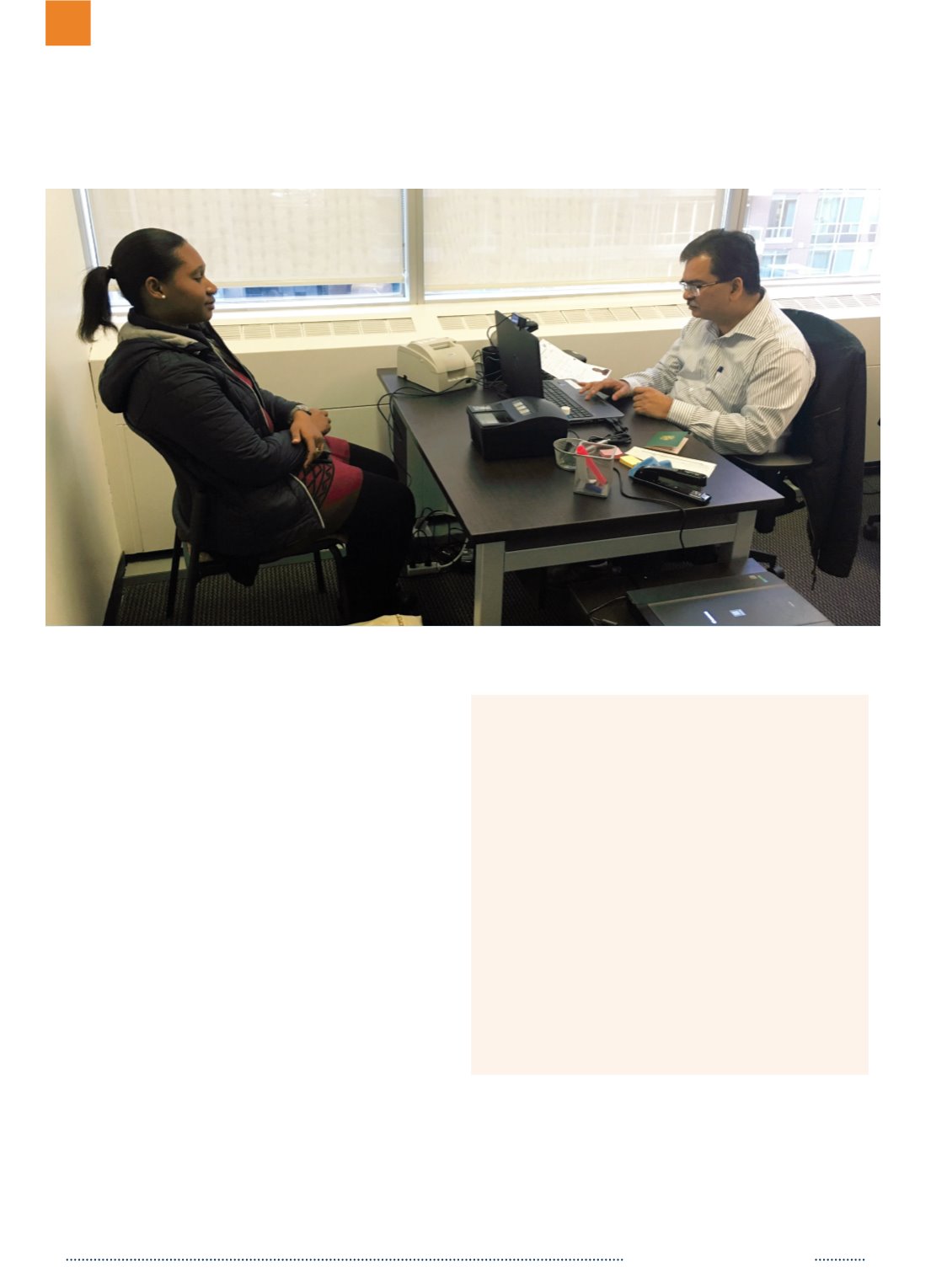

Bank Verification Number programme for Nigeria bank customers

operational in 9 countries

Biometric enrolment centres set up for Nigerian bank account holders

A VFS Global BVN Enrolment Centre in Toronto, Canada

Key strengths:

Speed and Agility: Centres were set up

within a short timeframe, about 2 to 4 weeks

Infrastructure: Leveraged on existing

infrastructure and resources to speedily

setup the centres

Robust Security: Centres were setup in

accordance with VFS Global’s stringent

quality and security standards

Trained Staff: Existing staff with experience

in biometric enrolment were deployed in

most locations to professionally manage

the centres

8.2

IDENTITY & CITIZEN SERVICES